Inflation Watch 2025: 4% Rate & Everyday Impact

Economists forecast a 4% annual inflation rate for 2025, significantly impacting the cost of everyday goods and services, and reshaping consumer financial strategies across the United States.

As we look ahead, the economic landscape of 2025 is drawing considerable attention, with many economists predicting an annual inflation rate of inflation watch 2025 reaching 4%. This projection raises important questions about the future cost of living, from groceries to housing, and how it will redefine financial planning for American households. Understanding the forces driving this forecast and its potential ramifications is crucial for everyone.

Understanding the 2025 Inflation Forecast

The anticipation of a 4% inflation rate in 2025 is not a random guess but a consensus built on various economic indicators and expert analyses. Several factors contribute to this outlook, ranging from ongoing supply chain adjustments to shifts in consumer demand and global geopolitical events. These elements collectively paint a picture of continued price pressures that could impact virtually every sector of the economy.

Economists typically use complex models that incorporate historical data, current trends, and future projections of key economic variables. These variables include wage growth, energy prices, fiscal policies, and the overall health of global trade. The 4% figure suggests a persistent inflationary environment, higher than the long-term target of 2% favored by central banks, indicating that the effects will be noticeable and require strategic responses from both consumers and businesses.

Key Economic Indicators Pointing to 4%

- Persistent Supply Chain Issues: Despite some improvements, bottlenecks in global supply chains continue to exert upward pressure on prices.

- Strong Labor Market: Continued wage growth, while beneficial for workers, can contribute to higher costs for businesses, which are often passed on to consumers.

- Energy Price Volatility: Geopolitical tensions and production decisions can lead to unpredictable fluctuations in oil and gas prices, directly affecting transportation and manufacturing costs.

- Government Spending and Fiscal Policy: The impact of past and potential future government spending programs can fuel demand, contributing to inflationary pressures.

The interplay of these factors creates a challenging environment for policymakers attempting to stabilize prices without stifling economic growth. The forecast serves as a critical alert, urging proactive measures to mitigate potential negative consequences for individuals and the broader economy. It also highlights the dynamic nature of economic predictions, which are constantly refined as new data emerges, but the current trajectory suggests a need for caution and preparedness.

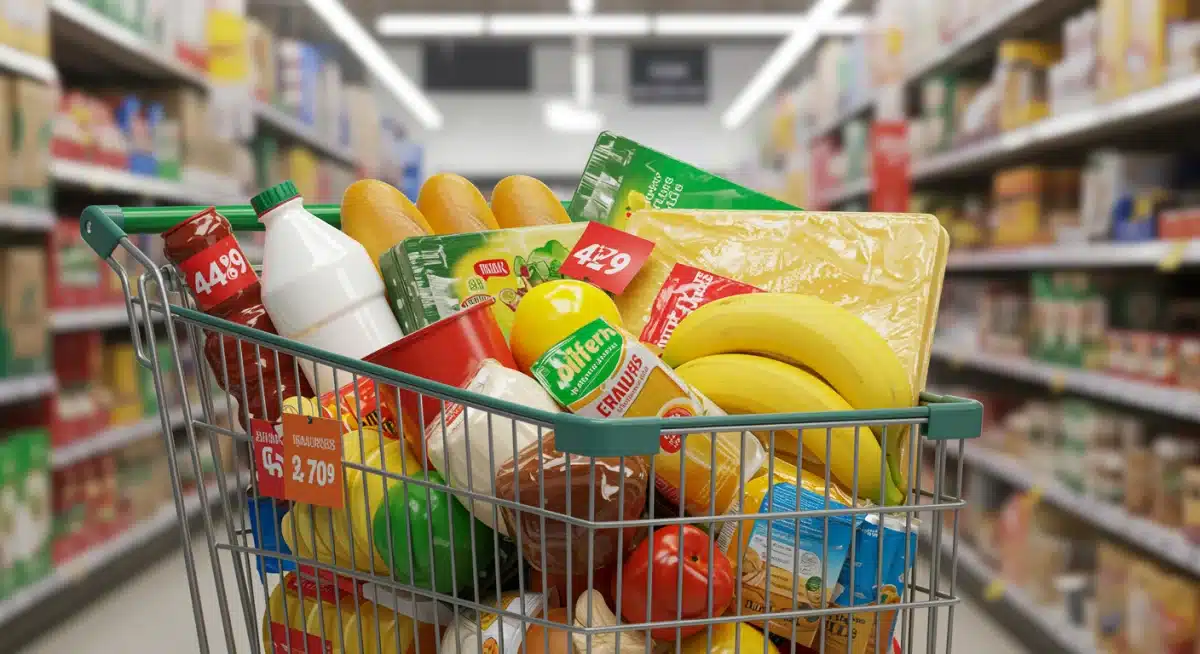

Impact on Everyday Goods: Groceries and Essentials

A 4% annual inflation rate directly translates into higher prices for the everyday goods that households rely on. Groceries, in particular, are often the first category where consumers feel the pinch of rising inflation. Staples like bread, milk, eggs, and fresh produce can see significant price increases, forcing families to adjust their budgets and purchasing habits. This can place a considerable burden on low-income households, where a larger portion of their budget is allocated to essential food items.

Beyond groceries, other essential items such as personal care products, cleaning supplies, and basic household goods are also expected to become more expensive. Manufacturers and retailers face increased costs for raw materials, labor, and transportation, which they invariably pass on to the consumer. This ripple effect means that the cost of maintaining a household will rise across the board, making careful budgeting and smart shopping strategies more important than ever.

Strategies for Consumers to Cope with Rising Prices

- Meal Planning and Smart Shopping: Planning meals in advance and purchasing items on sale or in bulk can help reduce grocery bills.

- Generic Brands: Opting for store-brand or generic products often provides similar quality at a lower price point.

- Comparing Prices: Using price comparison apps and checking different stores can help identify the best deals on essential goods.

- Reducing Waste: Minimizing food waste through proper storage and creative meal preparation can maximize the value of purchased items.

The cumulative effect of these price increases can erode purchasing power, meaning that a dollar buys less than it used to. This phenomenon is particularly challenging for those on fixed incomes or whose wages do not keep pace with inflation. Therefore, understanding these dynamics and adapting spending habits are crucial steps for navigating a potentially inflationary environment effectively, ensuring financial stability in the face of rising costs.

Housing and Utilities: Rising Costs Ahead

The impact of a 4% inflation rate extends far beyond the grocery store, significantly affecting major household expenses like housing and utilities. Rent prices, already a substantial portion of many Americans’ budgets, are likely to continue their upward trajectory. Landlords face their own increased costs, including property taxes, maintenance, and insurance, which are often factored into rental agreements. This can make finding affordable housing even more challenging, especially in competitive markets.

Homeownership is also not immune. While mortgage payments for fixed-rate loans remain stable, property taxes, homeowner’s insurance, and the cost of home maintenance and repairs will likely increase. Utility bills, covering electricity, gas, water, and internet services, are also subject to inflationary pressures. Energy prices, in particular, are highly sensitive to global supply and demand dynamics, and any increase directly impacts household budgets.

Navigating Increased Housing and Utility Expenses

To mitigate the effects of rising housing and utility costs, consumers might need to explore various strategies. For renters, negotiating lease renewals or considering more affordable living arrangements could become necessary. Homeowners might benefit from reviewing their insurance policies for potential savings or exploring energy-efficient upgrades to reduce utility consumption over time. Proactive planning is key to managing these substantial expenses.

- Energy Efficiency Upgrades: Investing in better insulation, smart thermostats, or energy-efficient appliances can reduce long-term utility costs.

- Budgeting for Utilities: Regularly reviewing and adjusting utility budgets to account for seasonal and inflationary increases.

- Exploring Public Assistance Programs: Some government programs offer assistance for utility bills or housing costs for eligible individuals.

- Refinancing Mortgages: For homeowners, exploring refinancing options if interest rates become more favorable, though this is less likely in an inflationary environment.

The combined pressure from housing and utility costs can strain household finances, potentially reducing discretionary income and impacting overall quality of life. Therefore, it is essential for individuals and families to carefully assess their current spending, identify areas for potential savings, and plan for these anticipated increases to maintain financial stability in the coming years.

Transportation Costs: Fueling Inflationary Pressures

Transportation is another major category where the effects of a 4% inflation rate will be acutely felt. Fuel prices, a significant component of transportation costs, are highly volatile and susceptible to global events. Higher crude oil prices, coupled with increased demand, directly translate to more expensive gasoline and diesel at the pump. This impacts not only individual commuters but also the entire supply chain, as businesses face higher costs for shipping and logistics, which are then passed on to consumers.

Beyond fuel, the cost of purchasing and maintaining vehicles is also expected to rise. New and used car prices can increase due to higher manufacturing costs, semiconductor shortages, and strong consumer demand. Vehicle insurance premiums, repair costs, and even public transportation fares are all subject to inflationary pressures. These increases collectively make getting around more expensive, impacting daily commutes, travel plans, and overall mobility for many Americans.

Mitigating Rising Transportation Expenses

Consumers can adopt several strategies to lessen the burden of increased transportation costs. One approach involves optimizing driving habits, such as carpooling, combining errands, or utilizing public transport where available. For those considering a new vehicle, prioritizing fuel efficiency or exploring electric vehicle options might offer long-term savings. Regular vehicle maintenance can also prevent costly repairs and improve fuel economy, extending the life of the vehicle.

- Public Transportation: Utilizing buses, trains, or subways can be a cost-effective alternative to driving, especially in urban areas.

- Carpooling and Ride-Sharing: Sharing rides with colleagues or friends can significantly reduce fuel and maintenance costs.

- Fuel-Efficient Vehicles: When purchasing a car, prioritizing models with high MPG ratings or considering electric vehicles can lead to long-term savings.

- Fuel-Efficient Vehicles: When purchasing a car, prioritizing models with high MPG ratings or considering electric vehicles can lead to long-term savings.

- Regular Vehicle Maintenance: Keeping tires properly inflated, getting regular oil changes, and performing routine check-ups can improve fuel efficiency and prevent expensive breakdowns.

The persistent rise in transportation costs underscores the interconnectedness of various economic factors. As businesses grapple with higher operational expenses, consumers ultimately bear the brunt through increased prices for goods and services. Adapting personal transportation habits and exploring more economical options will be essential for managing budgets effectively in an inflationary environment.

Healthcare and Education: Long-Term Financial Strain

The projected 4% inflation rate in 2025 will also exert considerable pressure on the costs of healthcare and education, two critical sectors with long-term financial implications for households. Healthcare expenses, already a significant concern for many Americans, are expected to continue their upward trend. This includes everything from insurance premiums and prescription drug costs to doctor’s visits and hospital services. Factors such as medical innovation, an aging population, and administrative overhead contribute to these rising costs, which inflation will only exacerbate.

Similarly, the cost of education, particularly higher education, is a growing burden for students and families. Tuition fees, textbooks, and living expenses for college students are all subject to inflationary pressures. This can lead to increased student loan debt and make it more challenging for individuals to access educational opportunities. The long-term impact on career prospects and financial stability can be substantial, emphasizing the need for careful financial planning in these areas.

Addressing Rising Healthcare and Education Costs

Managing the increasing costs of healthcare and education requires a proactive and strategic approach. For healthcare, exploring different insurance plans, utilizing preventive care, and understanding prescription drug savings programs can help. In education, considering community colleges, state universities, or vocational training programs can offer more affordable alternatives to private institutions. Scholarship applications and financial aid opportunities are also crucial resources for students.

- Preventive Healthcare: Focusing on wellness and preventive care can help reduce the need for more expensive treatments in the long run.

- Generic Prescriptions: Opting for generic versions of medications can significantly lower drug costs.

- Education Savings Plans: Utilizing 529 plans or other education savings vehicles can help families prepare for future tuition expenses.

- Scholarships and Grants: Actively seeking out and applying for scholarships and grants can reduce reliance on student loans.

The rising costs in healthcare and education highlight the broader challenge of maintaining financial well-being in an inflationary economy. These expenses represent substantial long-term investments, and their increasing price tags necessitate careful consideration and strategic planning to ensure access and affordability for all.

Investment Strategies in an Inflationary Environment

In an environment where economists predict a 4% annual inflation rate for 2025, traditional investment strategies may need to be re-evaluated. Inflation erodes the purchasing power of money over time, meaning that investments that do not yield returns higher than the inflation rate will effectively lose value. This necessitates a shift towards assets that historically perform well during periods of rising prices or offer a hedge against inflation. Investors need to consider how their portfolios are structured to protect their wealth.

Common strategies include investing in real assets, such as real estate or commodities, which tend to retain or even increase in value as inflation rises. Certain types of stocks, particularly those of companies with strong pricing power that can pass on increased costs to consumers, may also perform well. Additionally, Treasury Inflation-Protected Securities (TIPS) are specifically designed to protect investors from inflation, as their principal value adjusts with the Consumer Price Index (CPI).

Diversifying Portfolios for Inflation Protection

Diversification is always a key principle in investing, but it becomes even more critical during inflationary periods. Spreading investments across various asset classes can help mitigate risks and capture potential gains from different market segments. Consulting with a financial advisor can provide personalized guidance tailored to individual financial goals and risk tolerance, ensuring that investment decisions align with an overall strategy for inflation protection.

- Real Estate: Investing in properties or real estate investment trusts (REITs) can provide a hedge against inflation through rising property values and rental income.

- Commodities: Gold, silver, oil, and other raw materials often see their prices increase during inflationary times.

- Value Stocks: Companies with strong balance sheets and the ability to raise prices without losing market share tend to fare better.

- Inflation-Protected Securities: TIPS offer a direct hedge against inflation, as their principal value adjusts with the CPI.

Understanding the potential impact of inflation on investments is crucial for preserving and growing wealth. By adapting investment strategies to account for rising prices, individuals can better safeguard their financial future and ensure their savings maintain their purchasing power in the long run. Proactive portfolio adjustments are essential for navigating the complexities of an inflationary economy effectively and achieving financial resilience.

Government and Central Bank Responses to Inflation

As economists anticipate a 4% inflation rate in 2025, governments and central banks, particularly the Federal Reserve in the United States, will play a critical role in attempting to manage and mitigate its impact. Their primary tools for combating inflation typically involve monetary policy adjustments, such as raising interest rates, and fiscal policy measures, including government spending and taxation decisions. These actions are designed to cool down an overheating economy by reducing demand and stabilizing prices.

Raising interest rates makes borrowing more expensive, which can slow down consumer spending and business investment, thereby reducing overall demand in the economy. Central banks also use tools like quantitative tightening, where they reduce their balance sheets by selling off assets, further withdrawing liquidity from the financial system. Governments, on the other hand, can influence inflation through fiscal policy by adjusting spending levels or implementing tax changes that either stimulate or curb economic activity.

Challenges and Strategies for Policymakers

Policymakers face a delicate balancing act: curbing inflation without triggering a recession. This requires careful calibration of monetary and fiscal policies, often in response to evolving economic data. Communication from central banks is also crucial, as clear guidance on their intentions can help manage market expectations and influence economic behavior. The effectiveness of these measures depends on various factors, including the root causes of inflation and the overall health of the economy.

- Interest Rate Hikes: Central banks often raise benchmark interest rates to make borrowing more costly, thereby reducing aggregate demand.

- Fiscal Discipline: Governments can reduce budget deficits and control spending to avoid overstimulating the economy.

- Supply-Side Policies: Measures aimed at increasing productivity and resolving supply chain bottlenecks can address the root causes of some inflationary pressures.

- International Cooperation: Coordinating with other countries on trade policies and global supply chain management can help stabilize international prices.

The response from government and central banks will be a key determinant of how effectively the economy navigates the predicted 4% inflation in 2025. Their decisions will not only influence price stability but also have broader implications for economic growth, employment, and financial market conditions, making their actions a focal point for businesses and consumers alike.

| Key Aspect | Brief Description |

|---|---|

| 4% Inflation Forecast | Economists predict a 4% annual inflation rate for 2025, driven by various global and domestic factors. |

| Everyday Goods Impact | Significant price increases expected for groceries, household essentials, and consumer products. |

| Cost of Living Rise | Housing, utilities, and transportation costs are anticipated to climb, straining household budgets. |

| Investment Strategies | Investors may need to adjust portfolios towards inflation-protected assets to preserve purchasing power. |

Frequently Asked Questions About 2025 Inflation

A 4% inflation rate means that your money will buy 4% less goods and services each year. For example, an item costing $100 today would cost $104 next year, reducing your purchasing power over time.

Economists cite factors like persistent supply chain issues, a strong labor market leading to wage growth, volatile energy prices, and the lingering effects of government fiscal policies as key drivers for this forecast.

Your grocery bill is likely to increase significantly. Staples and essential food items will cost more, requiring consumers to implement smart shopping strategies, compare prices, and plan meals carefully to manage budgets.

Consider investing in inflation-protected assets like real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Diversifying your investment portfolio and consulting a financial advisor can also help safeguard your wealth.

Yes, central banks like the Federal Reserve typically use monetary policy tools, such as raising interest rates, to combat inflation. Governments may also employ fiscal policies like adjusting spending or taxation to stabilize prices.

Conclusion

The projected 4% annual inflation rate for 2025 presents a significant economic challenge, demanding proactive responses from individuals, businesses, and policymakers alike. From the rising costs of everyday essentials and housing to the long-term strains on healthcare and education, understanding these inflationary pressures is the first step toward effective mitigation. By adapting personal financial strategies, optimizing spending habits, and adjusting investment portfolios, consumers can better navigate this evolving economic landscape. Simultaneously, the strategic interventions of central banks and governments will be crucial in balancing price stability with sustainable economic growth, shaping the financial reality for Americans in the coming years.